Latest Trader Channel Posts

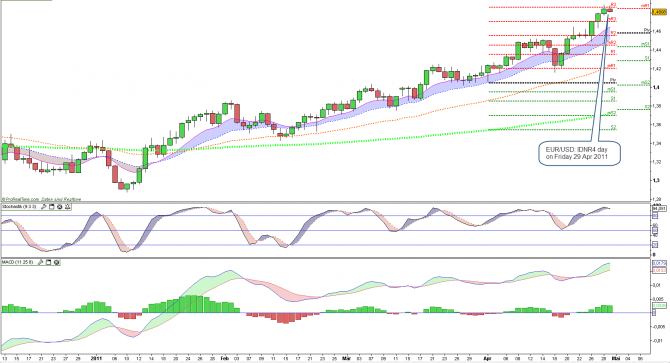

Once per month EUR/USD has an ID/NR4 day - as yesterday

On Friday EUR/USD had an ID/NR4 day. An inside day (ID) has a higher low than the previous day's low and a lower high than the previous day's high. An NR4 is a trading day with the narrowest daily range of the last four days. Historic data shows that in the last 24 months it has occurred 30 times with the EUR/USD pair (on average 1.25 times per month).

How to trade such a setup is described in “Street Smarts – High Probability Short Term Trading Strategies” by Linda Raschke and Laurence Connors in chapter 19 “Breakout Mode: Range Contraction":

How to trade such a setup is described in “Street Smarts – High Probability Short Term Trading Strategies” by Linda Raschke and Laurence Connors in chapter 19 “Breakout Mode: Range Contraction":

“In the breakout mode we can't predict the direction in which we are going to enter the trade. All we can do is predict that there should be an expansion in volatility. Therefore, we must place both a buy-stop and a sell-stop in the market at the same time. The price movement will then pull us into" the trade.

“In the breakout mode we can't predict the direction in which we are going to enter the trade. All we can do is predict that there should be an expansion in volatility. Therefore, we must place both a buy-stop and a sell-stop in the market at the same time. The price movement will then pull us into" the trade.

Here are the rules:

- Identify an ID/NR4.

- The next day only, place a buy-stop one tick above and a sell-stop one tick below the ID/NR4 bar.

- On entry day only, if we are filled on the buy side, enter an additional sell-stop one tick below the ID/NR4 bar. This means that if the trade is a loser, not only will we get stopped out with a loss, we will reverse and go short. (The rule is reversed if initially filled on the short side.)

- Trail a stop to lock in accrued profits.

- If the position is not profitable within two days and you have not been stopped out, exit the trade MOC (market on close.) Our experience has taught us that when the setup works, it is usually profitable immediately.”

You can also find the book as a pdf on the internet at this link.

Trade safely and may the Bayesian Probability be with you.